RELEASE: Kenya Partnership to Reduce Textile Waste Wins 2021 P4G Partnership of the Year Award

Subject

State-of-the-Art Partnership Awards

External article

Learn morePublication Date

2021-11-10

Partnership

Join P4G at COP: Mobilizing Finance to Reach Net Zero

External article

Read MoreCountry

Bangladesh, Republic of Chile, Republic of Colombia, Denmark, Ethiopia, Vietnam, Indonesia, South Africa, Kenya, The Republic of Korea, Netherlands, United Mexican States (Mexico)

Publication Date

2021-11-03

October 2021 Newsletter: Zero Waste Green Industry

External article

Read MoreCountry

Bangladesh, Republic of Chile, Republic of Colombia, Denmark, Ethiopia, Vietnam, Indonesia, South Africa, Kenya, The Republic of Korea, Netherlands, United Mexican States (Mexico)

Publication Date

2021-10-13

How a P4G Partnership is Accelerating E-mobility in Colombia

Subject

P4G Partnerships

Country

Publication Date

2021-10-07

About

“Community is what unites us, and this is what P4G enables,” Carlos Serrano, Leader of Sustainable Mobility for Renting Colombia, remarked at an event for P4G’s Sustainable Mobility in Cargo Transportation Partnership in Colombia. The event highlighted the partnership’s impact in expanding electric mobility in Colombia to shift the cargo logistics sector towards greater sustainability. The partnership has advanced its aims to build more sustainable cities and improve the quality of life for Colombians.

Diana Valencia, Director of Procurement for Bavaria, Colombia’s leading beverage company, shared the company’s goals of buying 100% of energy from renewable sources by 2025, while reducing emissions by 25% throughout their fleets by 2030. These goals, which align with the Colombian government’s national priorities, connected them to conversations with the Colombia Department of National Planning (DNP) and Renting Colombia to work on the proposal for a P4G partnership in 2019.

After conversations facilitated by First Lady of Colombia Maria Juliana Ruiz Sandoval, partners including Renting Colombia recognized P4G, with its systematic emobility portfolio and engaged Colombian national platform, as the perfect partner for a sustainable transportation project, shared Ana Maria Echeverry Merizalde, Commercial Vice President of Renting Colombia. Wanting to lead the market in sustainability, Renting Colombia set a goal of 1,000 vehicles powered by renewable energy, which they will reach in a few months.

For the scope of the P4G partnership, the partners set out three objectives of impact, including rolling out 200 electric trucks across Colombia; creating a learning environment to share efficiencies with other Colombian companies; and ensuring those with limited access, such as small businesses, would be included in the sustainable mobility ecosystem. This focus on making the business case for an interconnected system, where emissions affect everyone, helped the partnership be more successful in the end. “We need everyone to make the right decision so we can have this transformation,” Echeverry Merizalde said.

Alicia Lozano, Sustainability Manager at Bavaria, also emphasized the importance of cooperation for making the electric trucks ecosystem viable. She noted that P4G’s catalytic grant funding helped reduce the risk to implement pilot projects and document lessons learned around logistics and financing that demonstrated the model’s efficacy, thereby convincing other companies to adopt electric trucks. Lozano emphasized that although this transition is challenging, it is viable, which is why creating this platform for small and medium enterprises to proceed with more security is essential.

Shifting to specifics about the electric fleets the partnership rolled out, Carlos Serrano highlighted how they have worked to make the trucks more attractive to incentivize greater adoption. In their course, “Fund for Electric Trucks,” 27 companies participated, of which 20 piloted trucks that made deliveries across 58,000 kilometers in 4 months. With zero emissions from the vehicles, this project helped avoid 36.7 tons of Co2 emissions.

The event also featured the perspective of one of the companies in Colombia who participated in the electric truck pilot to demonstrate how sustainable transportation is attractive across sectors. Carolina Restrepo, Sustainability Project Coordinator at Expocafé, a coffee exporter, shared how their commitment to coffee sustainability has led them to pursue low-carbon transportation to complement sustainable farming practices.

Bringing in the government perspective, Jonathan Bernal, Director of Infrastructure and Sustainable Energy at DNP shared Colombia’s three principal public policy priorities, including energy efficiency, air quality and public health, and greenhouse gas emissions. The government has enacted several plans and policies to make logistics more competitive and efficient as they expand fleets of cleaner vehicles. The 2019 Cargo transport policy has set the goal of rolling out 2,000 zero emissions heavy vehicles in the next 15 years, an objective that the partnership has contributed to. Bernal thanked P4G for supporting this leading initiative aligned with Colombia’s objectives, stating “P4G shows us these interesting strategies along with the Bavaria partnership, and they’ve helped us think about establishing a fund for zero emissions fleets.”

To close the event, Daniel Mejia, P4G’s Regional Manager for Latin America, highlighted the partnership’s success in dismantling perceived barriers to electric mobility in Colombia and delivering electric vehicles across the country. Mejia also shared how the partnership fits into P4G’s broader portfolio on electric mobility and its work with the Colombian government to deliver significant impact ahead of the next P4G Summit, to be hosted by Colombia in 2023. “Working with passionate implementers such as Renting Colombia and Bavaria, it is clear that Colombia has significant potential to achieve transformative impact through domestically-driven solutions,” Mejia said.

Watch the full event (in Spanish) here.

P4G Provides Catalytic Capital to Kickstart Good Ideas

External article

Read MoreCountry

Bangladesh, Republic of Chile, Republic of Colombia, Denmark, Ethiopia, Vietnam, Indonesia, South Africa, Kenya, The Republic of Korea, Netherlands, United Mexican States (Mexico)

Publication Date

2021-09-28

Partnership

Accelerating E-Mobility Solutions for Social Change, FLAWLESS, Siklus,

New Approaches to Driving Industrial Energy Efficiency in Asia

Subject

Events

Publication Date

2021-09-23

About

As part of Climate Week 2021, P4G joined the Institute for Sustainable Communities (ISC) for a webinar on “Envisioning Green Partnerships for Driving Sustainable Manufacturing in South and Southeast Asia.” At the event on September 21, leading industrial energy efficiency organizations from Vietnam, Indonesia, India, and the Philippines laid out the status of energy efficiency in their country and pitched their solutions for scaling efficiency in energy service companies (ESCOs). In a shark tank style approach, panelists from funding institutions responded with insights on how to improve and scale approaches to accelerate the development of an active ESCO market.

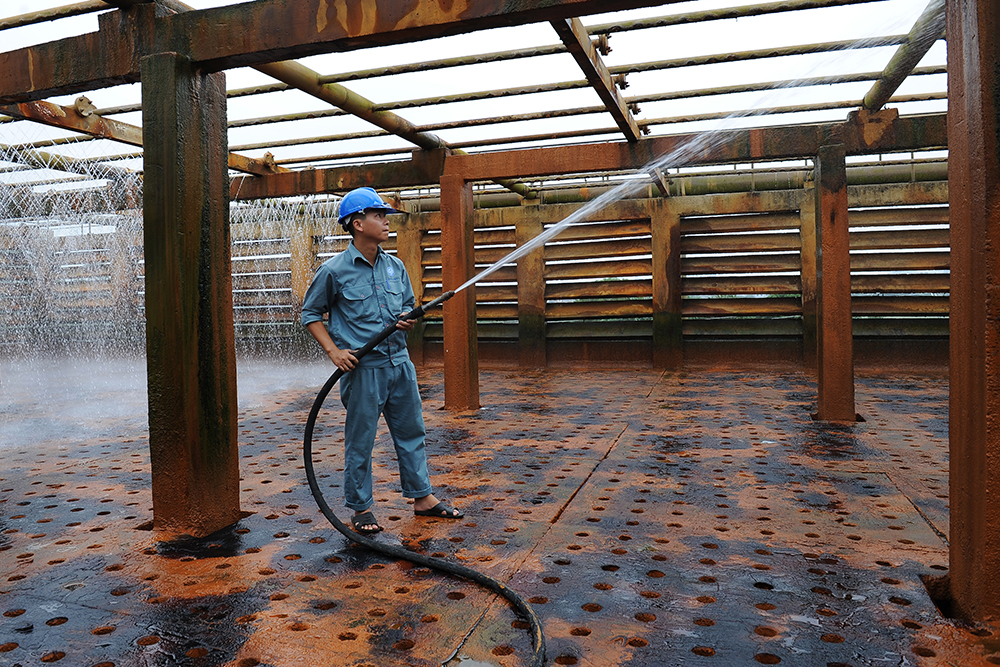

Introducing the pitch session, Mark Lister, Managing Partner, Asia Clean Energy Partners, highlighted the importance of decarbonizing through scaling practical solutions relevant to each country. Lister shared perspectives from Vietnam, which uses 54% of its energy in industry, such as cement and steel. Despite attempts by the national government to enforce programs for energy efficiency, the ESCO sector is underdeveloped, especially at the local level. Lister called for de-risking measures to encourage private investment, as well as capacity building in ESCO sectors so industry players know what solutions and technologies they can use to improve energy efficiency.

Jon Respati, Chairman, Indonesia Energy Conservation and Efficiency Society (MASKEEI) shared how Indonesia has set national decarbonization targets, but energy efficiency is not mandatory across sectors. Many small and medium enterprises lack awareness about the potential benefits of energy saving for their businesses, while ESCOs struggle to secure adequate funding from financial institutions that fail to understand the merits of energy efficiency. Thus, MASKEEI advocates for incentives that will enhance new regulatory prospects to make energy efficiency mandatory and set clearer, more realistic target across all sectors. Through public-private partnerships, de-risking mechanisms and trading carbon certificates in coordination with government and relevant private sector actors, Indonesia can be a leader in industrial energy efficiency.

According to Mohammed Zahidul Haque, Senior Vice President and United Head, Infrastructure Development Company Limited (IDCOL), energy efficiency is indispensable to improve productivity and working environments in Bangladesh. Through its updated nationally determined contribution (NDC), the country plans to reduce GHG emissions in power transport and industry by 5% by 2030, which they could increase with more international funding and technological support. Haque outlined options including credit guarantee schemes, capacity development initiatives, and green bonds as ways to provide additional finance for effective project development. Haque noted that ESCOs play a pivotal role, but these conversations need to incorporate more vulnerable small businesses to make sure they are able to meet energy efficiency targets.

Poonam Pande, Deputy Head International, Energy Efficiency Services Limited (EESL) noted that 56% of India’s total energy consumption comes from industry, and micro, small and medium enterprises (MSMEs) are responsible for 20-25% of that. EESL is working to drive better industrial energy efficiency by leveraging economies of scale through bulk procurement, demand-driven aggregation, and Pay As You Save measures. They plan to transform the industrial sector by delivering energy efficient technologies to 1,500 MSMEs, which will provide visible savings of 15 – 35% based on the technology and sector and have the potential to reduce carbon emissions by 1 million tons per year. In calling for more funding, Pande noted “We have been able to demonstrate effectiveness, but we need more to scale up.”

Closing out the pitches, Alexander Ablaza, CEO of Climargy and Co-chair of the Asia-Pacific ESCO Industry Alliance, shared the Philippines experience, where private capital is moving toward renewable energy, but there’s still a barrier to energy efficiency improvements, which require double the capital and lack entities that will de-risk upfront project development costs. Climargy arranges equity and debt providers through ESCO contracts, mobilizing $108 million in initial investment tranches, which has the potential to avoid excess energy generation of 300 GWh/year by 2031 and create between 2,100-3,900 jobs. Ablaza highlighted how the problem is not just end-user adoption, but initial capital raising. He called on institutional investors to devote more upstream money to take on risk and help get more of these companies off the ground.

Kicking off the responses, Shalabh Tandon, Regional Head of Operations, South Asia at the International Finance Corporation (IFC) acknowledged that solving energy efficiency challenges for MSMEs has been a challenge for IFC, but they are working on scaling up efforts in game changing sectors, such as power, green transport, and manufacturing. He highlighted four steps needed to develop industrial energy efficiency: demand aggregation, technical assistance, access to finance and making business models commercially viable and credit-worthy. He noted that countries are in different stages, but they need to work through these steps, and IFC hopes to collaborate with them to eventually create a super ESCO platform to implement the innovative solutions needed.

Anjana Seshadri, Vice President of NEEV Fund, shared the fund’s approach to solving poverty and climate change by increasing equity support and risk mitigation for green infrastructure. Through an ecosystem of investment prospects, NEEV fund helps ESCOs address initial funding challenges by serving as an early-stage funder to share risk. The next challenge will be on designing models that can continue to accelerate through blended finance.

Sharing his excitement about the new sources of funding for ESCO models, Sarbinder Singh, Director of Investments, P4G noted that if governments adopt these models and dedicated funds can invest in the approach, they will become catalytic in saving energy. “Energy efficiency is like peeling an onion, each measure you take means things will keep improving,” he said. Singh also shared P4G’s approach of working with partners like ISC to bring more innovative solutions into play through multistakeholder partnerships, so the impact becomes permanent and the transition moves faster.

Markus Bissel, Project Director for Vietnam, GIZ shared the fund’s approach to providing technical assistance for energy efficiency in Vietnam, where GIZ helped the government develop an ambitious national energy efficiency program and law that resulted in high energy savings for the 3,000 companies that consume 40% of Vietnam’s energy. Markus also raised the challenge of how to convince companies to invest in energy efficiency which competes with renewable energy as a more visible and easier option.

ESCOs will continue to work on answering the hard questions to accelerate adoption of industrial energy efficiency across South and Southeast Asia. As Vivek Adhia, India Program Director, ISC reflected on the tremendous opportunity for energy efficiency, “now is the time to make bold decisions and accelerate clean teach adoption.”

Watch the full session here.

September Newsletter: Food and Agriculture

.jpg)

External article

Read MorePublication Date

2021-09-14

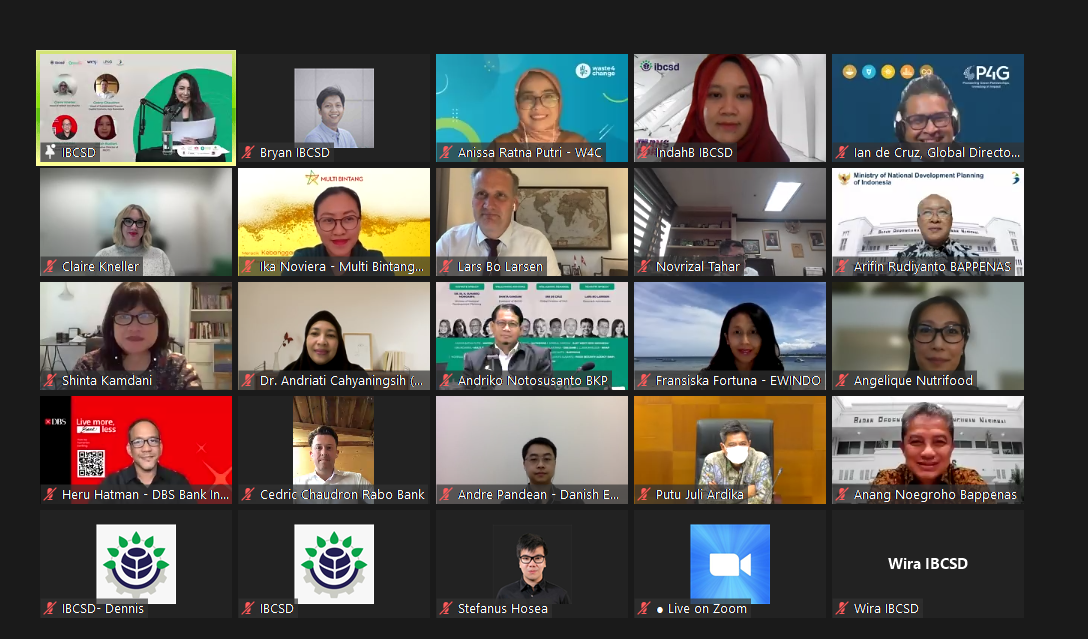

Major Corporations in Indonesia Take Action to Reduce Food Loss and Waste

About

On September 8, P4G partnership The Halving Food Loss and Waste by Leveraging Economic Systems (FLAWLESS) launched a Voluntary Agreement in Indonesia bringing together top corporates to act on reducing food loss and waste (FLW). The Voluntary Agreement, GRASP 2030, is a public-private partnership that will implement a Target-Measure-Act-Invest approach to tackling food loss and waste. Eight signatories have signed on to GRASP 2030 including major Indonesian businesses such as East West Seed Indonesia, Multi Bintang and Nutrifood to take tangible action and deliver impact in the form of food loss reduction and savings.

Shinta Kamdani, President of the Indonesia Business Council for Sustainable Development (IBCSD) and P4G National Platform Co-Chair, kicked off the launch by highlighting the private sector’s role in driving a more sustainable food system in Indonesia. Through the Voluntary Agreement, businesses can increase their capacity to manage food waste across their operations.

Through the Target-Measure-Act-Invest Approach corporations commit to FLW reduction targets, measure their waste, take concrete action to produce measurable food loss and waste reduction and monetize these savings through innovative financial products.

P4G Global Director, Ian de Cruz in his introductory remarks shared the economic, social and environmental benefits of this approach and importance of reducing FLW to achieve a net zero future for all. He highlighted the intentional alignment of this partnership with Indonesia’s national priorities and global agendas.

Indonesia loses 4 –5% of its GDP because of food loss and waste. All the food wasted could meet the nutrient needs of 61-125 million people a year. Arifin Rudiyanto, Deputy Minister for Maritime and Natural Resources Affairs, Ministry of National Development Planning (Bappenas) outlined these stark figures as driving reasons behind Indonesia’s commitment to address food and loss waste by strengthening its policies through its Low Carbon Development Initiative. GRASP 2030 complements the government’s plans to strengthen the FLW legal framework and develop food distribution platforms.

Lars Bo Larsen, Ambassador of Denmark to Indonesia, spoke of the different sources of food loss and waste such as in production and transportation in developing countries and in consumption and retail in developed countries. He shared a few solutions Denmark has successfully implemented to address its food waste across the value chain from apps that sell surplus food to Danish cold chain technologies that have reduced post-harvest banana wastage in India by 20%.

Claire Kneller, Head of WRAP Asia Pacific, shared the concrete results Voluntary Agreements have produced in the United Kingdom where a 1.7 million ton reduction in food waste translated to a savings of £4.7 billion pounds and reduced greenhouse gas emissions by 5 million tons. She spoke about the scaling and replication potential of the FLAWLESS model with P4G that has now launched in South Africa and Mexico.

Representatives from banks also attended the launch and shared their interest in partnering with this model. Cedric Chaudron, Head of Sustainable Finance, Rabobank, highlighted how every $1 invested in addressing food waste can yield up to $14 in returns. He also spoke about the bank’s SDG12.3 loan issued to corporates in the Netherlands where if a company meets its FLW reduction targets, it would get rewarded by a margin discount; if it underperforms it would incur a margin premium. He shared how there are similar opportunities to pursue financial products with companies in Asia.

Indah Budiani, Executive Director of IBCSD, underscored how GRASP 2030 presents an opportunity for businesses to determine their priorities for action once waste hotspots are identified. She spoke of IBCSD’s role as a facilitator to collect data and identify actors who can deliver tangible food savings impact.

The different signatories of GRASP 2030 spoke about actions they have already taken to reduce FLW and their commitment to scaling up efforts as part of the Voluntary Agreement. Fransiska Fortuna, General Manager Corporate Affairs, East West Seed Indonesia (EWINDO), a company whose products are used by more than 7 million vegetable farmers spoke about EWINDO’s attempt to reduce post-harvest waste in pumpkin production. The company set a new target of harvesting 20 tons of seeds, a significant increase from its current rate of 1 ton of seeds. It’s also working with farmers to process pumpkins for use in other products such as cans and soups.

Ika Noviera, Corporate Affairs Director, PT Multi Bintang Indonesia, the company that produces Bintang and Heineken beers in Indonesia spoke about their zero waste to landfill target and measures to successfully recycle 97% of beer byproducts.

Adriko Noto Susanto, Head of Food Availability and Reservation Center, Food Security Agency shared his strong support of this private-public collaboration. He mentioned Indonesia’s FLW reduction targets in areas like rice from 20.9% to 11% and outlined tangible steps they were taking to meet those targets, including supplying combine harvesters, changing packaging and providing infrastructure assistance.

More than 160 people attended the launch, which brought together stakeholders from the government, private sector, civil society and investors in pursuit of taking collective action to significantly reduce food loss and waste in Indonesia. As Shinta Kamdani candidly said at the top of the event when she urged all stakeholders to unite and put their full efforts behind tackling this challenge, “There is no Planet B.”

Learn more about the FLAWLESS partnership’s work in Indonesia, Mexico and South Africa here.

Strategies for Driving Green Investments in Emerging Markets

.png)

About

“If you want a greener future, you can’t ignore emerging markets” noted Vivek Pathak, Director and Global Head of Climate Business, International Finance Corporation (IFC) at the Climate Investment Summit on September 7, 2021.

Pathak’s comments were part of the session on “Public Private Partnerships for Increased Climate Mitigation Investments in Emerging Markets.” Led by the Climate Investment Coalition, one of P4G’s knowledge and investment partners, the event focused on increasing investments in climate and green recovery to reach 2030 goals and support the net zero transition.

Damilola Ogunbiyi, CEO, Sustainable Energy for All, provided keynote remarks about the urgency of taking climate action that addresses the needs of vulnerable communities in developing countries. She noted the clear link between energy access and climate mitigation, highlighting that we can’t get to net zero by 2050 if we don’t achieve SDG7 by 2030. “The pace of the global energy transition hinges on leveraging finance in emerging markets,” Ogunbiyi said. The need for catalytic investment in highly vulnerable regions is urgent to meet energy targets, ensure economic productivity, and get people out of poverty.

Moderating the solutions-driven discussion, Ian de Cruz, Global Director, P4G, highlighted the economic benefits of a transition in which investors to invest early in high-risk, high-impact projects in developing countries. “The global investment value chain from donor development finance to investment capital is fragmented and disconnected and needs to be transformed to address the challenge ahead of us,” he said.

Jason Lu, Head and Lead Infrastructure Finance Specialist, Global Infrastructure Facility (GIF), shared GIF’s work in addressing the weakest link of the value chain, project preparation. In order to create a pipeline of investable projects, it provides programmatic support to build standards and capacity with local governments and institutions, as well as facilitating knowledge transfer. For example, in Indonesia, GIF has worked with the government to create a de-risking mechanism for the country’s significant geothermal energy potential. By providing concessional loans, the private sector has the incentive and risk assurance needed to move from exploratory to more expanded drilling.

Vivek Pathak shared IFC’s work in bridging capital gaps in emerging markets to de-risk investments in green growth projects. He argued that there isn’t a shortage of capital for green projects, rather there’s enough financing if there are well-structured projects with a fair risk to reward allocation. This is why standards are so important – investors want insurance that there are fair, transparent, and consistent standards for their investments. To develop these standards, IFC has worked with government regulators and the private sector in developing countries. For example, their Planet Emerging Green One Fund with Amundi will invest $2 billion from G7 countries’ pension funds into developing markets.

Hanna Kaskela, Director of Responsible Investments, Varma, shared experiences from the private sector in managing sustainable investment opportunities. She noted that investors want to invest in assets that mitigate climate change, but they also want those investments to be low-risk. Kaskela underscored the need to avoid only addressing the easy solution of changing something that is bad without promoting an alternative that can reap the most benefit. For example, many initiatives call for shutting down coal plans and moving away from investments in dirty energy, but they don’t direct investors to alternative clean energy projects that they can shift their financing toward. A smooth transition in these scenarios will be essential to avoid a development crisis, as well as an energy crisis.

With engaging questions from participants, the discussion addressed how to make sure investments from developed countries are going to local entrepreneurs and building domestic capacity to respond to climate challenges. Pathak shared how IFC has worked to green domestic financial sectors to help scale up climate lending and train national banks to identify viable projects. Pathak urged that local context is key, noting that IFC tries to adapt successful models in which investors can diversify their risk. Through donor capital, partnerships that create investable projects, and financial institutions that de-risk pools of assets, he laid out how to build a pipeline that can crowd in the trillions of investment needed to meet climate challenges. Pathak highlighted that “green makes good business sense.”

Lu built on Pathak’s comments about the encouraging trend of more developing country governments engaging in project preparation facilities as national development banks invest more upstream. Going forward, it will be crucial to form stronger partnerships at the domestic level to bring the private sector closer with the local perspective. By working in parallel with donor capital, countries can co-invest in innovative projects ready to deliver the change needed on the ground.

The speakers reiterated their commitment to working together and continuing to tackle the hard questions. P4G looks forward to continuing to build the pipeline and doing the work needed to reach an equitable, net zero world for all.

Learn more about the full Summit here.

August Newsletter: Digital Solutions for Water